The Expert Accounting Software Loved by Small Businesses Across India. Smart, seamless, and built for results Your partner in small business accounting services with automation that works exactly how Indian firms do.

Simplify everyday accounting with intelligent automation that connects invoices, bank statements, and ledgers - saving hours each week.

Eliminate mismatches and manual entry errors with AI-powered reconciliation and automated verification tools.

From GST to audit reports - ensure complete compliance. Trusted by accountants, MSMEs, and finance professionals nationwide.

Get on-call help from CA experts and our dedicated support team - because automation works best when guided by real professionals.

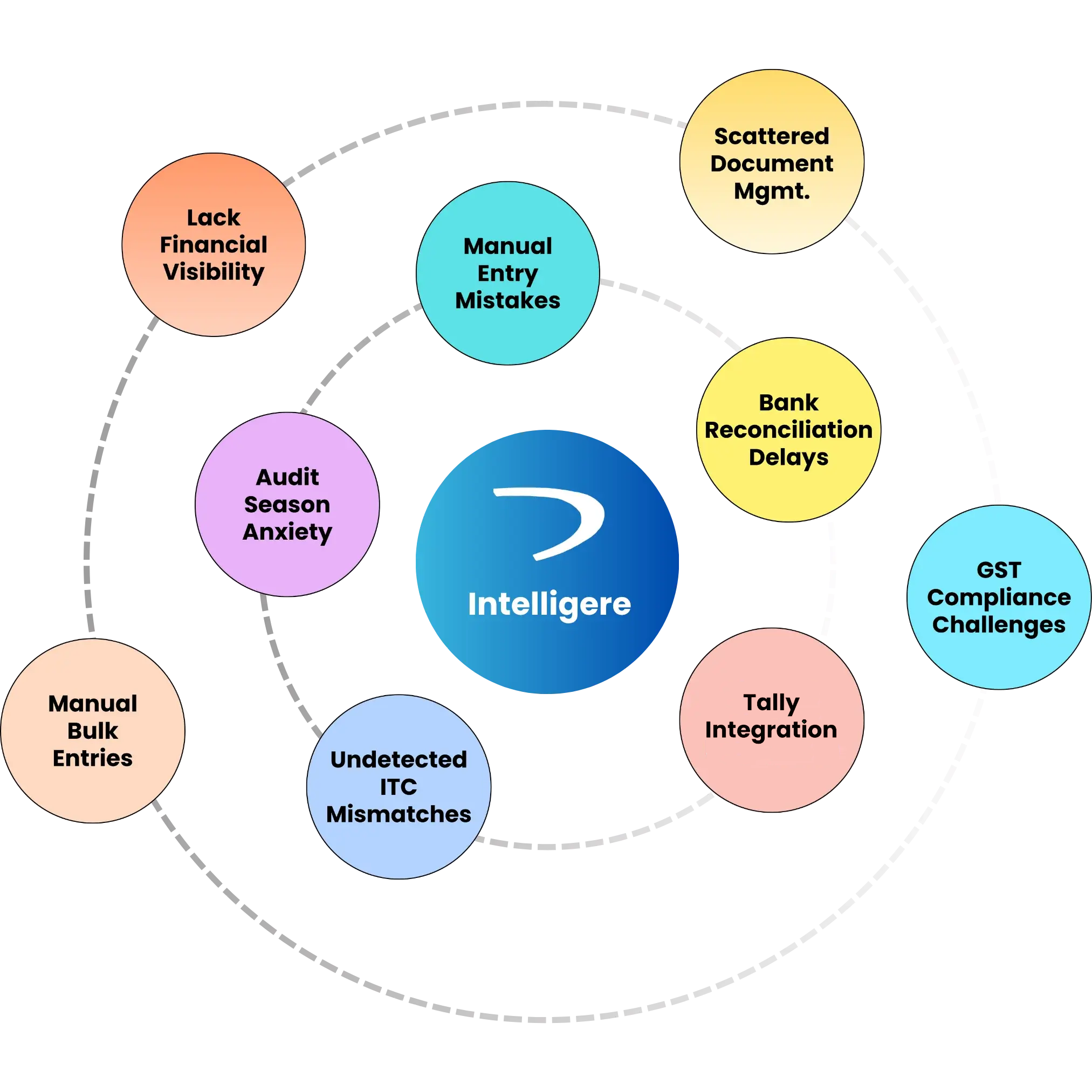

Manual bookkeeping causes costly errors, delays, and compliance headaches. Intelligere, the best accounting software in India, solves these problems for CAs, MSMEs, and small businesses through intelligent automation, AI accuracy, and smart document workflows.

Discover how Intelligere brings every accounting, GST, and documentation process into one platform. Our SMART Modules include powerful tools like Invoice Create, GST Compare, Bank Reconciliation, and DocuVault, with options for custom accounting software tailored to your workflow.

What Our Clients Say About Their Journey with Intelligere.

No testimonial available

Intelligere is an ERP agnostic accounts automation software. Whether you're using Tally, any other ERP, or none at all, Intelligere simplifies and accelerates your finance workflows with advanced automation.

Yes. Intelligere is ERP-agnostic. As long as your software provides APIs or integration options, Intelligere can exchange data seamlessly.

Absolutely. Intelligere uses bank-grade encryption security protocols to ensure full data protection. Your data cannot be shared, exposed, or accessed by anyone including us without your explicit permission. We follow strict, zero-access protocols to ensure complete privacy and control remain in your hands.

Only as long as you maintain your relationship with Intelligere. Upon discontinuation, your data can be securely deleted, or fully downloaded as per your request.

Currently, Intelligere supports electronic PDFs (machine-generated PDFs, not scanned images) and CSV files for data imports.

Intelligere typically achieves near-perfect extraction accuracy for well-formatted data. Complex, inconsistent, or unstructured files may require minimal manual verification before posting.

Intelligere works on globally accepted double-entry bookkeeping principles, fully aligned with standard financial and audit frameworks.

Yes. Intelligere supports multiple users with controlled access levels to ensure security and accountability across your team.

No. Intelligere is designed for finance teams, not coders. It's simple, intuitive, and comes with guided help, tooltips, and video tutorials for every function.

Our integration team is constantly expanding compatibility. You may contact our support team, and we’ll explore integration options based on your software.

Simply upload your e-PDF or CSV bank statements; Intelligere reads, maps, and generates voucher entries automatically.

Currently, we support data fetching from almost all leading Indian banks and regularly update integrations.

Yes. Intelligere identifies transaction types and creates accurate voucher entries for each category.

Yes. You always have full control to review, edit, or approve entries before final posting.

Yes. Daily uploads enable real-time reconciliations, reducing month-end workload.

Upload both GSTR-2B and purchase data — Intelligere auto-matches line items, highlights mismatches, and calculates accurate ITC.

Yes. Prefilled GSTR-3B data with matched/unmatched entries is generated for easy filing.

Yes. Clear reporting identifies mismatches for vendor-wise reconciliation.

As frequently as you upload data — even daily, for ongoing compliance.

Yes. RCM details are accurately captured and reflected.

Yes. Bulk B2B & B2C sales uploads are supported through CSV files.

Both inventory and non-inventory sales are handled seamlessly.

Yes. Sales data integration supports accurate ITC adjustments.

Yes. Multi-rate invoices are fully supported for accurate GST calculations.

Yes. Sales vouchers are auto-created for Tally after user verification.

Upload GST portal Excel files; Intelligere maps and processes them automatically.

Yes. Bulk B2B purchases are handled efficiently.

Yes. Smart algorithms prevent posting duplicates into Tally.

Yes. User verification is always part of the workflow.

Yes. Vendor-wise reporting is available for audits and filings.

Yes. Bulk uploads are supported via pre-formatted templates or GST portal exports.

Yes. Adjustment entries are auto-posted after verification.

Yes. Both tyoes are supported with correct ledger mapping.

Yes. Once approved, postings are automated.

Yes. Every adjustments is fully traceable with audit history.

Upload GST portal Excel files; Intelligere maps and processes them automatically.

Yes. Bulk B2B purchases are handled efficiently.

Yes. Smart algorithms prevent posting duplicates into Tally.

Yes. User verification is always part of the workflow.

Yes. Vendor-wise reporting is available for audits and filings.

Yes. Bulk uploads are supported via pre-formatted templates or GST portal exports.

Yes. Adjustment entries are auto-posted after verification.

Yes. Both tyoes are supported with correct ledger mapping.

Yes. Once approved, postings are automated.

Yes. Every adjustments is fully traceable with audit history.

Yes. You can create standard and e-invoices that comply with GST requirements within Intelligere.

Yes. Stock and inventory items can be integrated for accurate financial and inventory reporting.

Yes. Once approved, voucher entries are auto-posted to Tally.

Yes. Generated invoices can be instantly shared via email or downloadable links.

Recurring invoice functionality can be configured depending on business processes.

You can upload invoices downloaded from the GST portal, and Intelligere will automatically read, match, and convert them into purchase voucher entries.

No. Once the data is uploaded, voucher entries are auto-generated with GST breakup and mapped to the correct ledgers.

Yes. Bulk invoice import is fully supported for high-volume B2B accounting.

Yes. Intelligere provides GST component-wise visibility including CGST, SGST, IGST for detailed reviews..

Smart validation prevents duplicate voucher entries and alerts you to inconsistencies before posting.

It simplifies petty cash, fund allocation, and bulk expense distribution tasks.

Yes. Upload Excel sheets with distribution logic, Intelligere handles the entries.

Yes. Multi-head distribution is fully supported.

Yes. Periodic bulk distributions can be easily scheduled.

Yes. Vouchers are created and synced directly into Tally.

Yes. Any ledger can be retrieved, reviewed, and exported instantly.

Yes. PDFs are generated with complete ledger histories for auditors.

Yes. Vendor ledgers are available securely across devices.

Yes. Access is permission-controlled for data security.

Yes. You can select custom date ranges for export.

A secure document repository for storing financial files, contracts, GST records, and more.

Yes. Documents are shared via encrypted channels without email risk.

Admins fully control who can access, edit, or download files.

Yes. With controlled permissions, auditors can securely review documents.

Yes. A unified dashboard shows both payables and receivables, categorized by vendor or customer.

Yes. Payment timelines are tracked and updated based on invoice terms, helping you plan better.

Yes. Payables and receivables data can be exported for external reporting or follow-ups.

Absolutely. By offering real-time visibility into payables and receivables, you can make smarter disbursal and collection decisions.

Yes. A unified dashboard shows both payables and receivables, categorized by vendor or customer.

Yes. Payment timelines are tracked and updated based on invoice terms, helping you plan better.

Yes. Payables and receivables data can be exported for external reporting or follow-ups.

Absolutely. By offering real-time visibility into payables and receivables, you can make smarter disbursal and collection decisions.

You get detailed reports on sales, purchases, ITC status, cash flow, profit & loss, and more ready for decision-making or audit.

Yes. Reports can be filtered and grouped by the type of data you require.

Yes. Reports can be exported for sharing or recordkeeping.

Yes, You can generate reports for custom timeframes - weekly, monthly, quarterly, or even daily.

Yes. The reports auto-refresh based on the latest uploaded and posted data in Intelligere.